More metals will be needed to build all the solar panels, wind turbines, electric vehicle batteries and other technologies needed to combat climate change. Mining these metals from the earth causes damage and pollution, threatening ecosystems and communities. But the copper, nickel, aluminum and rare earth minerals needed to stabilize the climate have another potential source: the mountains of electronic waste humans throw away every year.

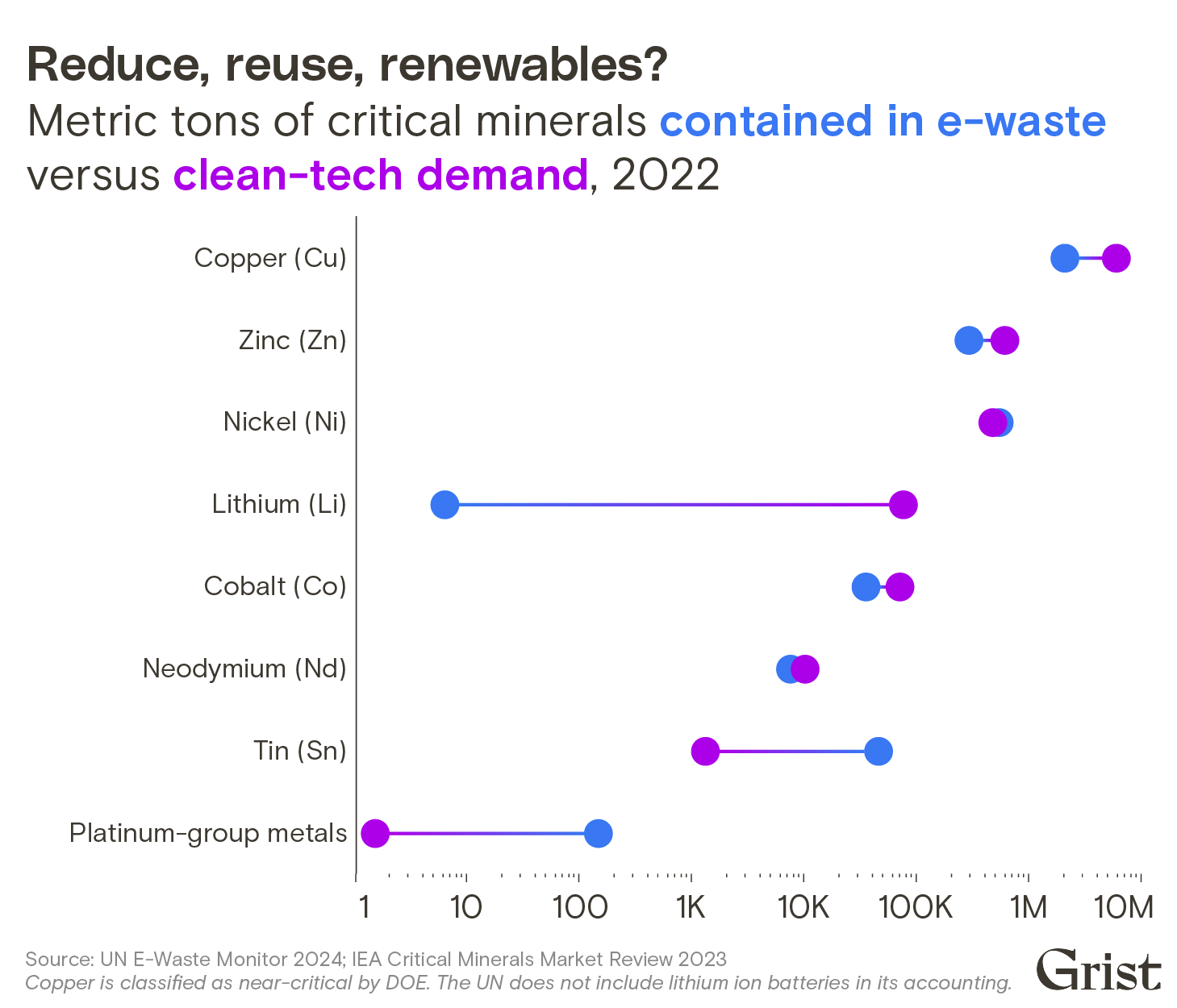

How much clean energy metal is contained in discarded laptops, printers and smart refrigerators around the world? Until recently, no one really knew. Data are particularly hard to come by on lesser-known metals such as neodymium and palladium, which play a small but crucial role in existing and emerging green energy technologies.

Now, the United Nations has taken the first step toward filling these data gaps, releasing the latest edition of its regular report on e-waste around the world. A new Global E-Waste Monitor report released last month shows the staggering scale of the e-waste crisis, which reached a new record with 62 million tonnes of electronics discarded globally in 2022. The report provides the first detailed look at the metal content of e-waste and how often it is recycled.

There are few reports on metal recycling [from e-waste] Kees Bald, the lead author of the report, told Grist that on a global scale. We believe we have a responsibility to put more facts on the table.

One of these facts is that some staggering amounts of energy transition metals end up in the trash.

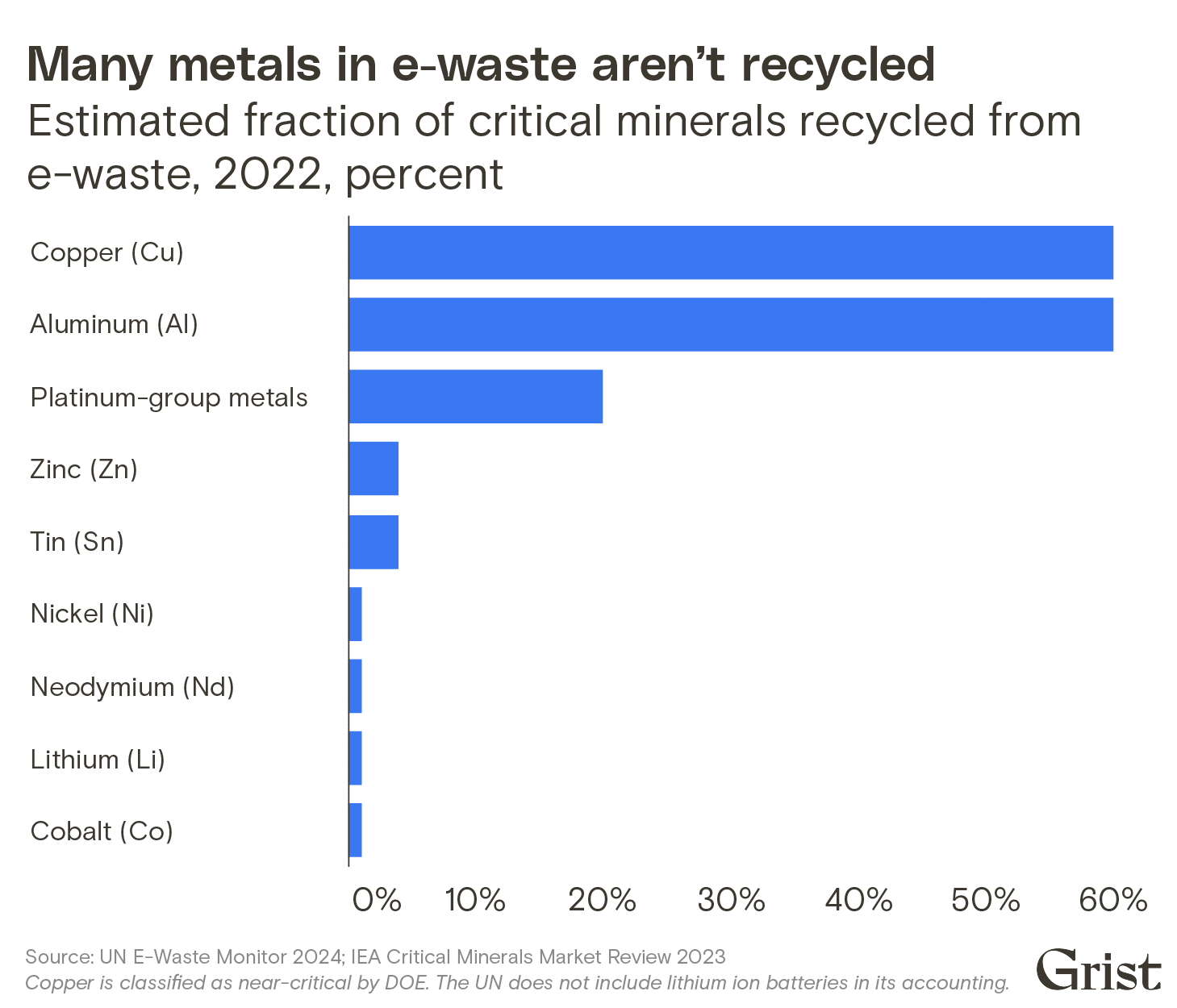

The two most recyclable metals abundant in e-waste are aluminum and copper. Both will play an important role in the energy transition: copper wires are ubiquitous in a range of low- and zero-carbon technologies, from wind turbines to transmission lines carrying renewable energy. Aluminum is also used in some power cords and as a lightweight structural support metal for electric vehicles, solar panels, and more. However, e-waste is expected to contain 4 million tons of aluminum and 2 million tons of copper in 2022, of which only 60% will be recycled. Millions more tons end up in landfills around the world.

The world could use this discarded metal. According to the International Energy Agency (IEA), copper demand from the climate technology industry will approach 6 million tons by 2022. If the world aggressively reduces emissions to limit global warming to 1.5 degrees Celsius, copper demand from low-carbon technologies could nearly triple by 2030.

At the same time, due to the pressure of energy transition, aluminum demand is expected to grow by 80% by 2050. On average, primary aluminum production produces more than 10 times more carbon emissions than aluminum recycling, and as demand for the metal grows, increasing recycling is a key strategy to control aluminum’s carbon footprint.

For other energy transition metals, recovery rates are much lower. Take the rare earth element neodymium, for example, which is used in permanent magnets in everything from iPhone speakers to electric car motors to offshore wind turbine generators. Balde and his colleagues estimate that there will be 7,248 tons of neodymium in e-waste globally by 2022, roughly three-quarters of the 9,768 tons needed by the wind energy and electric vehicle industries that year, according to the IEA. However, the recovery rate of all rare earths in e-waste is less than 1% due to the immaturity of the underlying recycling technology and the cost and logistical challenges of collecting rare earth-rich components from the technology.

Balder said collecting and separating rare earth magnets for recycling is cumbersome. Despite rapidly growing demand for rare earths from the electric vehicle and wind energy industries, there is no push from the market or lawmakers to recycle them.

Metals present in e-waste are not necessarily useful for all climate technology applications, even if they are recycled. Take nickel for example. By 2022, the number of lithium-ion batteries consumed in electric vehicles will exceed 300,000 tons. According to the IEA, the amount of nickel needed for electric vehicles could increase tenfold by 2050. However, although the world’s e-waste will contain more than 500,000 tons of nickel by 2022, most of it is in alloys such as stainless steel. Kwasi Ampofo, chief metals and mining analyst at energy consultancy BloombergNEF, said the nickel is not separated but recycled into other steel products. Some of this recycled steel may end up in wind turbines and other zero-emission technologies. But it won’t directly help meet the larger nickel demand in the electric vehicle battery market.

In other cases, e-waste may represent an important supply of a special energy transition metal. Although present in small amounts, certain platinum group metals found inside printed circuit boards and medical devices are highly recycled due to their value. Some of these metals, such as palladium, are used in the production of catalysts for hydrogen fuel cell vehicles, said Jeremy Mehta, technical manager for the U.S. Department of Energy’s Advanced Materials and Manufacturing Technologies Office.Mehta said recovering palladium from e-waste could help meet growing demand for these metals in fuel cell technology and clean hydrogen production, supporting the transition to clean energy..

For the energy transition to make the most of metals in e-waste, better recycling policies are needed. This could include policies requiring manufacturers to consider disassembly and recycling when designing products. Josh Blaisdell, director of Minnesota-based metal recycling company Enviro-Chem Inc., said metals such as copper are not recycled, often because it is in smartphones or other small consumer devices and cannot be easily disassembled.

In addition to recycling design standards, Balde believes metal recycling requirements are needed to push recyclers to recover some of the non-precious metals, such as neodymium, that are present in small amounts in e-waste. To this end, the European Council approved a new regulation in March setting a target that by 2030, 25% of critical raw materials consumed in the EU, including rare earth minerals, will come from recycled sources. While it’s not a legally binding goal, Balde said it could lead to legislation pushing for metal recycling requirements.

Mehta told Grist that recovering more metals from e-waste will be challenging, but there are many reasons to do so. That’s why last month, the U.S. Department of Energy (DOE) launched an E-Waste Recycling Award that will award up to $4 million to companies with proposals that could significantly increase the production and recycling of critical materials from e-waste. Contestants using ideas.

[W]The U.S. Department of Energy’s Mehta said we need to increase domestic supplies of critical materials to combat climate change, respond to emerging challenges and opportunities, and strengthen our energy independence. Domestic recycling of e-scrap is a significant opportunity to reduce our reliance on hard-to-source virgin materials, making it less energy intensive, more cost-effective and safer.

#surprising #amount #energy #transition #metals #consigned #trash

Image Source : grist.org