It’s easy to understand why investors would be attracted to companies that aren’t profitable. For example, biotechnology and mining exploration companies often lose money for many years before a new processing method or mineral discovery becomes successful. Despite the well-known success, investors shouldn’t overlook the many unprofitable companies that simply burn through all their cash and go out of business.

so it should Sophia Genetics (NASDAQ: SOPH ) shareholders worried about its cash burn? For the purposes of this article, cash burn refers to the rate at which an unprofitable company spends cash each year to fund its growth; its free cash flow is negative. We first compare its cash burn to its cash reserves to calculate its cash runway.

Check out our latest analysis for SOPHiA GENETICS

When will SOPHiA GENETICS run out of money?

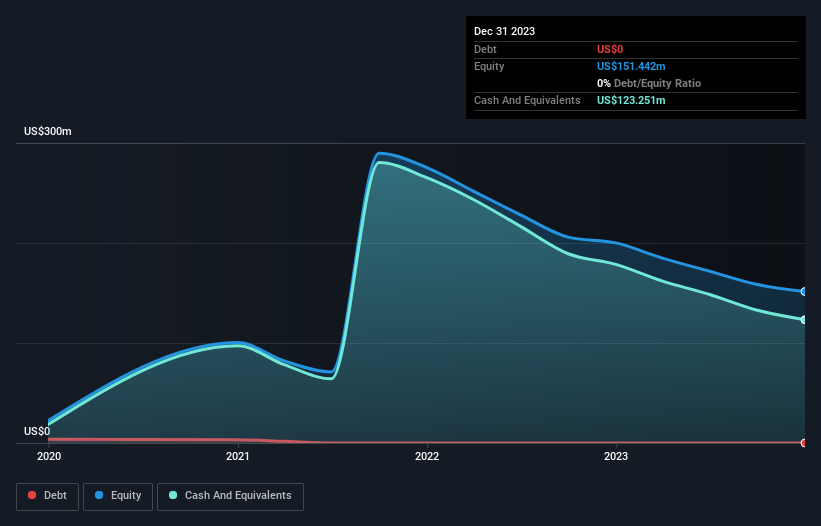

The company’s cash runway is the time it would take to burn through its cash reserves at its current cash burn rate. As of December 2023, SOPHiA GENETICS had $123 million in cash and no debt. Importantly, its cash burn was US$58m in the last 12 months. This means it has a cash runway of approximately 2.1 years as of December 2023. Shown below, you can see how its cash holdings have changed over time.

How is SOPHiA GENETICS developing?

We think the fact that SOPHiA GENETICS reduced its cash burn by 28% last year is quite encouraging. On top of that, operating income grew 31%, which is an exciting combination that looks to be growing well. Clearly, however, the key factor is whether the company can grow its business in the future. So it makes sense to take a look at what our analysts are forecasting for the company.

Could SOPHiA GENETICS easily raise more cash?

There’s no doubt that SOPHiA GENETICS appears to be in a pretty good position when it comes to managing its cash burn, but even if that’s just hypothetical, it’s always worth asking how easily it can raise more capital to fund growth. Generally speaking, listed companies can raise new cash by issuing shares or raising debt. One of the main advantages of public companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company’s cash burn to its market capitalization to get an idea of how many new shares it would need to issue to fund a year of operations.

SOPHiA GENETICS has a market value of US$324 million and burned US$58 million last year, accounting for 18% of the company’s market value. Therefore, we dare say the company has no problem raising more cash to fuel growth, albeit at the expense of some degree of dilution.

How dangerous is SOPHiA GENETICS’ cash burn situation?

SOPHiA GENETICS appears to be in pretty good health in terms of cash burn. Not only is its cash runway quite good, but its revenue growth is also very positive. While we’re the type of investor who’s always a little concerned about the risks involved in cash-burning companies, the metrics we discuss in this article make us relatively comfortable in SOPHiA GENETICS’s case.Digging deeper into the risks, we find 2 warning signs for SOPHiA GENETICS What you should know before investing.

certainly SOPHiA GENETICS Might Not Be the Best Stock to Buy.So you might want to check this out free A collection of companies that have high return on equity, or a list of stocks that insiders are buying.

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative information. Simply Wall St has no position in any of the stocks mentioned.

#SOPHiA #GENETICS #NASDAQ #SOPH #ability #drive #business #growth

Image Source : finance.yahoo.com