US video streaming company Netflix, tech giant Apple and BP multinational Shell are among the high-profile global companies entering Kenya’s Voluntary Carbon Market (VCM), according to a recent World Bank report.

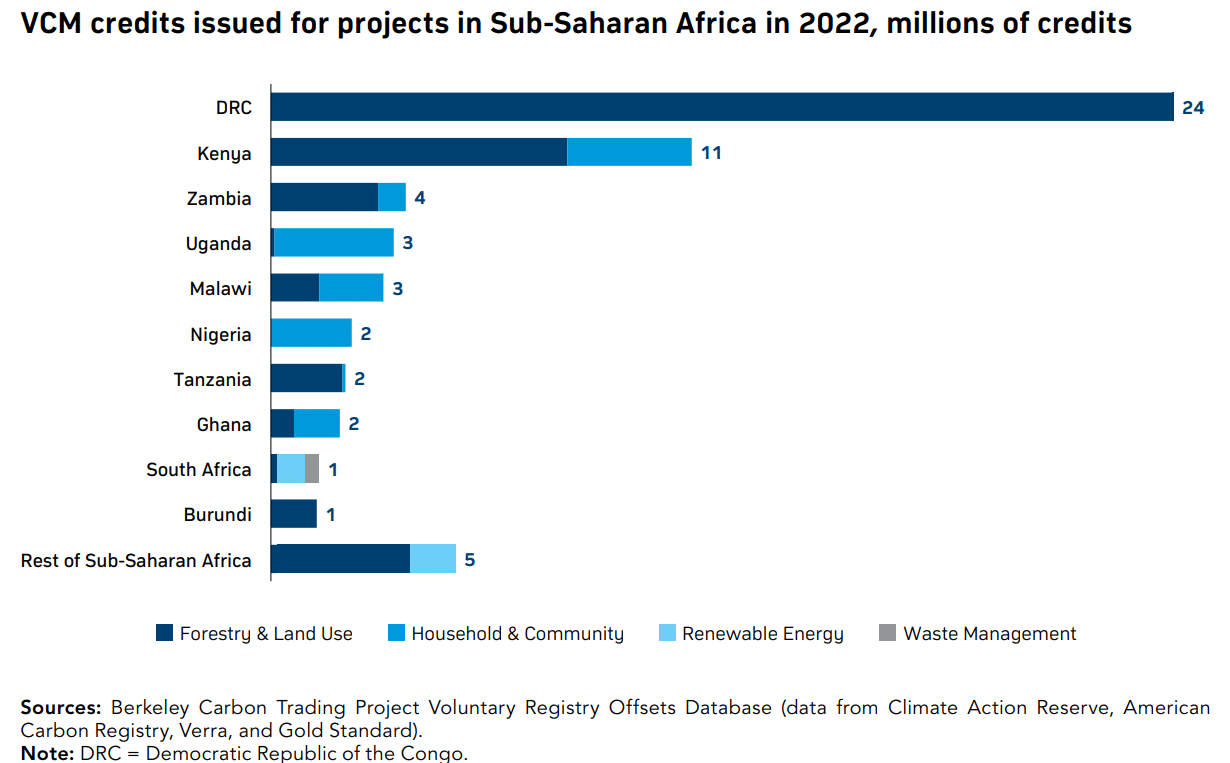

The report titled “Carbon Market Guide for Kenya Enterprises” shows that in 2022, Kenya will become the second largest issuer of VCM carbon credits in Africa, second only to the Democratic Republic of the Congo.

Since the launch of the African Carbon Market Initiative (ACMI) in 2022, Africa’s huge carbon credit potential has been unleashed. ACMI aims to mobilize climate finance on the African continent and focus on clean energy access and sustainable development. By leveraging carbon markets, ACMI directs funds toward emissions reduction projects, tackles energy poverty and promotes renewable energy.

From Hollywood to oilfields: Big players enter Kenya’s carbon market

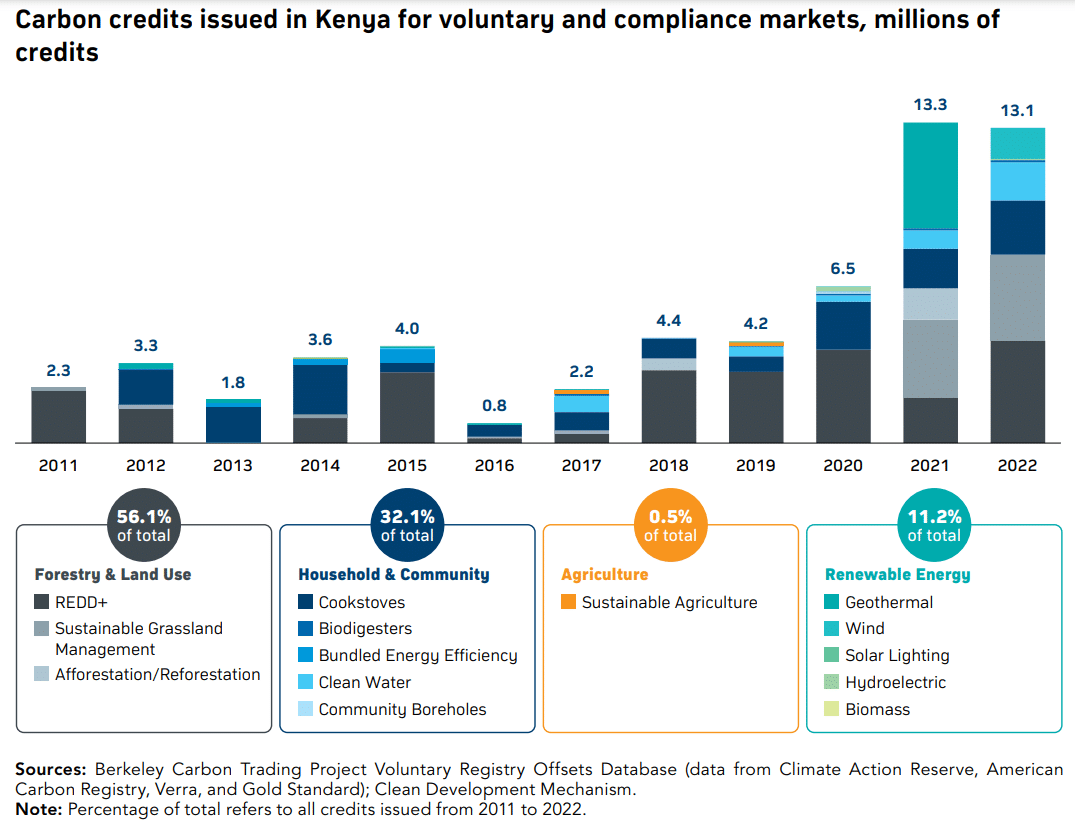

Since 2011, Kenya has issued more than 59 tonnes of carbon credits to projects. Eighty-three percent of these credits come from the voluntary market.

Most of the voluntary carbon credits issued in Kenya come from nature-based schemes. However, the report further highlights that technology-based projects are beginning to appear on the market.

In the carbon credit market, organizations and individuals purchase credits generated through emission reduction projects to offset their carbon footprint. Companies whose operations pollute pay large sums to support measures designed to remove or absorb carbon dioxide from the atmosphere.

Each credit represents the reduction or removal of one ton of carbon dioxide from the air, which is often achieved through programs focused on combating deforestation, particularly in developing countries.

The report pointed out that the main purchasers of VCM points in Kenya are large companies such as Netflix, Apple, Shell, Air France-KLM, BHP Billiton, Delta Air Lines and Kering Group. Other prominent companies participating in Kenya’s carbon credits market include South Africa’s Nedbank, Switzerland’s Nespresso and Zenlen Inc.

Uncovering Kenya’s Carbon Credits

The report highlights that most of the carbon credits generated in Kenya in the voluntary market are attributed to forestry and land use programmes. Specifically, the credits have been extended to four developers, three of which are located in Kenya:

- wildlife work carbon,

- Chyulu Hills Conservation Trust, and

- Northern Rangeland Trust.

These organizations contribute to the generation of carbon credits through initiatives aimed at reducing emissions from deforestation and forest degradation (REDD+). They also focus on implementing sustainable grassland management projects to support local environmental conservation efforts.

Additionally, household and community credit, especially stove-related credit, is another important type of credit generated in the country.

However, there is limited transparency into the price paid for these points. They are mainly sold over the counter through bilateral negotiations, so exact prices are difficult to determine. The companies responsible for these credits are more fragmented and often rely on carbon credit revenue to make profits.

A small proportion of the credit generated in Kenya is also sold in compliance markets through the CDM.

The World Bank previously estimated that the cost of removing one ton of carbon dioxide is $40 and $80 Building on the Paris Climate Agreement. However, the exact price of these Kenyan credits has not yet been disclosed.

Carbon credit boom: Kenya emerges as Africa’s contender

In 2021, several large companies purchased carbon credits from Kenya and Uganda. Delta Air Lines purchased a total of 1,164 kilotonnes of carbon equivalent (KtCOe) from the two countries, while Netflix and BHP Billiton purchased 699 and 200 KtCOe from Kenya alone.

In 2022, Kenya received 11 million VCM credits, making it the second largest issuer of carbon credits in Africa, after the Democratic Republic of Congo (which issued 24 million carbon credits).

Zambia, Uganda and Malawi disbursed 4 million, 3 million and 3 million credits respectively.

As awareness grows about the environmental impact of industries such as fossil fuels, agriculture, fashion and transport, there are calls for carbon credits as a vital source of revenue for Kenya. President William Ruto has been advocating for carbon credits to reduce emissions and generate revenue for the country.

At the 28th United Nations Climate Summit (COP28) in Dubai last December, Kenya joined other countries in emphasizing the importance of carbon markets as a complement to emissions reduction efforts. Countries emphasized the need for transparency and high-integrity standards to maximize the effectiveness of these markets.

To this end, Kenya’s Ministry of Environment has released draft regulations regulating the carbon market. One of the proposals stipulates that 25% of the revenue generated by the sale of carbon credits by private companies would be paid directly to the government.

Additionally, the ministry plans to establish a national carbon register that will serve as a repository of all carbon credits issued or recognized. Private companies must register with the registry and pay a fee to begin accruing carbon credits.

These measures aim to ensure market accountability and transparency while providing a framework for generating revenue and protecting jobs.

Kenya’s voluntary carbon market is attracting attention from global players, with tech giants and oil companies also joining the fray. As Africa unlocks the potential of carbon credits, Kenya aims to use this market to combat climate change and promote sustainable development.

#Netflix #Apple #Shell #Delta #join #Kenyas #carbon #credit #boom

Image Source : carboncredits.com