You may know, Myriad Genetics, Inc. (NASDAQ: MYGN ) just released its latest first-quarter results, posting some very strong numbers. Myriad Genetics beat expectations with revenue of $202 million, beating estimates by 4.6%. The company also reported a statutory loss of US$0.29, 4.1% below forecasts. Analysts typically update their forecasts with each earnings report, and we can tell from their forecasts whether their view of the company has changed, or if there are any new concerns to be aware of. So we’ve gathered the latest post-earnings forecasts to see what’s in store for next year.

Check out our latest analysis for Myriad Genetics

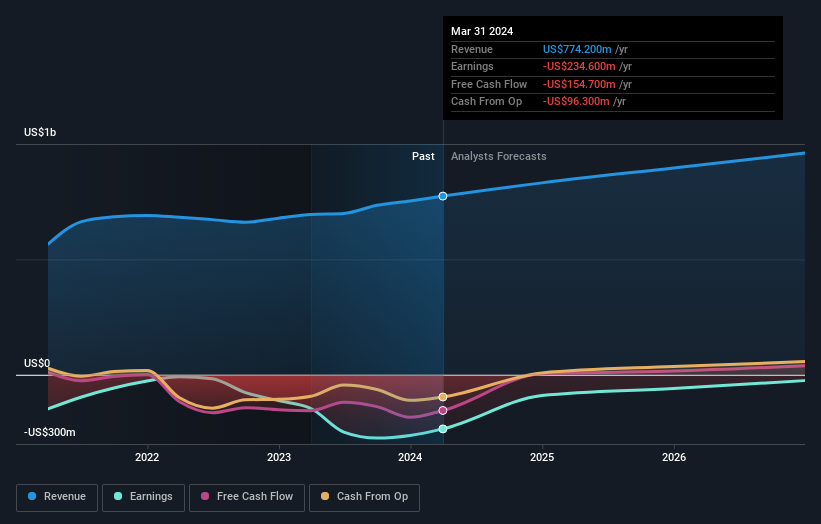

Taking the latest results into account, Myriad Genetics’ 11 analysts are predicting a consensus revenue of $831.5 million in 2024. Loss per share is expected to decrease significantly in the near term, narrowing 65% to $0.90. Before this earnings report, analysts had been forecasting revenue of $827.9 million and a loss of $0.93 per share in 2024. Revenue numbers were unchanged, but losses per share were forecast.

There were no significant changes to the consensus price target of $25.10, suggesting the reduction in loss estimates isn’t enough to have a long-term positive impact on the stock’s valuation. However, that’s not the only conclusion we can draw from this data, as some investors also like to consider the difference in estimates when assessing analyst price targets. There are some varying sentiments on Myriad Genetics, with the most optimistic analyst valuing it at US$35.00 per share and the most pessimistic valuing it at US$17.00 per share. That’s a fairly broad estimate, showing analysts are predicting a variety of possible outcomes for the business.

Now looking at the bigger picture, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth forecasts. One thing worth noting about these forecasts is that Myriad Genetics expects to grow faster in the future than in the past, with revenue expected to grow at an annualized rate of 10.0% by the end of 2024. . Compare this to analyst estimates for the broader industry, which suggest that (overall) industry revenue is expected to grow 19% annually for the foreseeable future. Therefore, although Myriad Genetics’ revenue growth is expected to improve, it is still expected to grow slower than the industry.

bottom line

On top of that, analysts reconfirmed their forecasts for losses per share next year. On the bright side, there are no major changes to revenue forecasts; although forecasts suggest they will perform worse than the industry as a whole. The consensus price target held steady at $25.10, with the latest estimates not enough to have an impact on its price target.

With this in mind, we still think it’s more important for investors to consider the long-term trajectory of the business. Here at Simply Wall St we have a full range of analyst forecasts for Myriad Genetics out to 2026, which you can view for free on our platform.

Also, you should know 1 warning sign We discovered Myriad Genetics.

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative information. Simply Wall St has no position in any of the stocks mentioned.

#Analysts #weigh #Myriad #Genetics #Inc.s #NASDAQ #MYGN #firstquarter #report

Image Source : finance.yahoo.com